does idaho have capital gains tax

County tax rates range throughout the state. A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

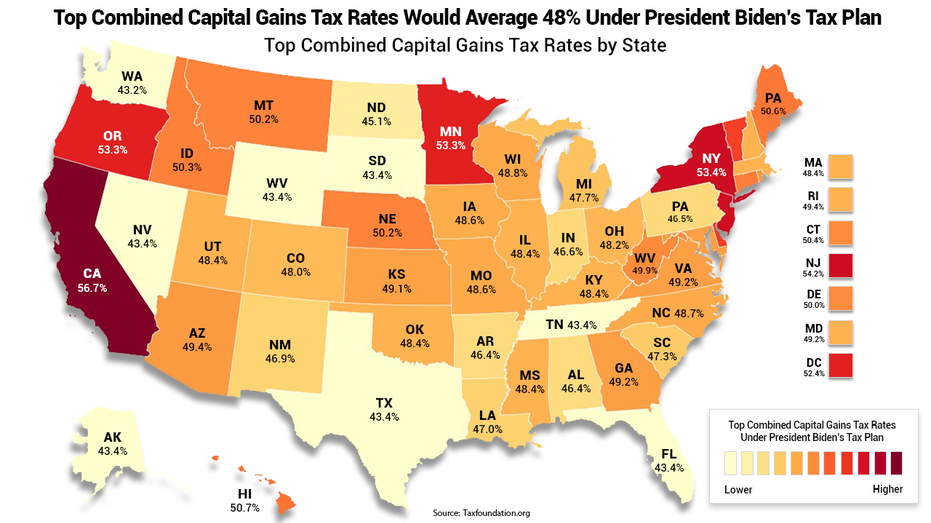

States have an additional capital gains tax rate between 29 and 133.

. See the instructions for the definition of qualified Idaho property. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. If not whats wrong.

Wages salaries 100000 Capital gains - losses -50000. 208 334-7660 or 800 972-7660 Fax. State Tax Commission PO.

Does Idaho have an Inheritance Tax or an Estate Tax. Your income and filing status make your capital gains tax rate on real estate 15. 500000 for married couple - will not be taxable.

The percentage is between 16 and 78 depending on the actual capital gain. Form CG Capital Gains Deduction and Instructions 2019 Author. Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single.

The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. Idahos tax system ranks 17th overall on our 2022 State Business Tax Climate Index. A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes.

Idahos maximum marginal income tax rate is the 1st. Net operating loss amounts can differ between federal and state. The good news is that it is possible to sell your house in Idaho and avoid paying capital gains tax.

A capital gains tax is placed on any asset that rises in value. Idaho State Tax Commission Keywords. An individual will be exempted from paying any tax if their annual income is below a predetermined limit.

The rate reaches 693. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. The Idaho Income Tax.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Up to 60 of the net capital gains reported on the federal return from the sale of qualified Idaho property may be deducted on the return. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801.

Idaho does not levy an inheritance tax or an estate tax. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. A majority of US.

If you are married and file jointly you can exclude 500000 of. A majority of US. List qualifying capital gains and losses.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Idaho axes capital gains as income. Additional State Capital Gains Tax Information for Idaho.

Below is a list of income that needs to be added to your Idaho return. Should I Refinance My Mortgage. Is the simplified tax example below correct.

Up to 25 cash back Experience. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. Dont include gains and losses reported on lines 2.

States have an additional capital gains tax rate between 29 and 133. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Right off the bat if you are single they will allow you to exclude 250000 of capital gains.

Question regarding when the 3000 limit is applicable. You will be able to claim the allowable Idaho portion in the Deductions section. 208 334-7846 taxrep.

This is your Idaho capital gains deduction. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Taxidahogovcontact Specific Instructions Line 1.

The rates listed below are either 2021 or. Federal Net Operating Loss Carryforward. The capital gains rate for Idaho is.

Each states tax code is a multifaceted system with many moving parts and Idaho is no exception. If your property was acquired during 2008 and 2009 do not enter any amounts here. The good news is that it is possible to sell your house in idaho and avoid paying capital gains tax.

Box 36 Boise ID 83722-0410 Phone. Section 63-105 Idaho Code Powers and Duties - General Income Tax. Taxes capital gains as income and the rate is a flat rate of 495.

Enter the total NOL if any as shown on your federal return. Subscribe to our Newsletter. The rates listed below are either 2021 or 2020 rates whichever are the latest available.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Capital gains for farms is. Taxes capital gains as income and the rate is a flat rate of 495.

For individuals of 60 years or younger the exempted limit is Rs. The IRS provides a few ways to avoid paying capital gains tax on real estate sales. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Idaho. Form 39NR Part B line 6. Residential Indians between 60 to 80 years of age will be exempted from long-term capital gains tax in 2021 if they earn Rs.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Calculate Your Capital Gains Tax.

Wealthy Donors Grow War Chest For Pac Seeking To Overturn State S Capital Gains Tax Mynorthwest Com

Two State Senators Propose Doubling New Capital Gains Tax For Financial Managers Washington Bigcountrynewsconnection Com

State Taxation As It Applies To 1031 Exchanges

Historical Idaho Tax Policy Information Ballotpedia

Trial Court Sides With Super Rich On Capital Gains Tax The Stand

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Can You Avoid Capital Gains Tax In Nebraska Element Homebuyers

2021 Capital Gains Tax Rates By State Smartasset

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax Passes House Heads To Senate For Concurrence Washington State Wire

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

The States With The Highest Capital Gains Tax Rates The Motley Fool